Happy April, everyone. It’s that time of year again… things turning green, baseball back in action, and of course, everyone’s favorite… tax time! What effect did Trump and his tax bill have on our tax return? The Benjamins household finally finished their 2018 return and the result was overwhelmingly positive.

I have to admit, I was pretty curious as to how it would all pan out, this being the first year under the new tax law and all. Would we pay more? Would we pay less? Only the 1040 had the answer!

A brief Benjamins tax history

2018 marked the third year Mrs. Benjamins and I filed jointly as married. Summarizing the first two years as a disaster would be an understatement. We owed a substantial amount the first year, mostly due to not getting our withholding correct (side note for all you newlyweds: if the difference in earnings between spouses is substantial, make sure both of you are withholding enough). The second year was a tad better, but we still had a pretty large tax bill come April.

I guess it’s better to owe than giving the government a tax-free loan. I’d rather owe than receive a refund, assuming we don’t owe so much as to pay a penalty for underpayment. Lots of people enjoy getting a refund, but I’d rather get the money owed to me sooner and get it invested sooner.

After two years of swallowing a hefty tax bill, we vowed year three would be better and made sure to get our withholding correct.

And then along came…

Tax Cuts and Jobs Act of 2017

President Trump signed a sweeping tax reform into law on December 22, 2017, fundamentally changing the individual tax brackets, deductions and the corporate tax rate.

There have been plenty of debates before and since this law passed on its effect on the US economy and how much the average citizen would benefit. This space is not for continuing that debate.

It’s essential to separate your own personal political feelings from whatever reality exists in the here and now. It doesn’t matter if I support the new tax law or what my opinion of it is. For my saving and investing purposes, all that matters is it’s the law of the land. I’ll save my opinions for the voting booth.

We do know that many corporations have been using their tax savings on dividends and share buybacks, but that’s a topic for another post. It’s only now that people are seeing first hand how the new law affects them.

Rumblings and Grumblings

There has been a lot of press covering people’s reactions to their smaller tax refunds this year, which leads one to believe that maybe the law didn’t help the average American as many believed it would.

But does this tell the whole story?

With the new tax law, many folks submitted an updated W9, which provides guidance on how much of your employer should withhold from paycheck for taxes.

What few people know is that with the new tax law came a new, lower withholding rate. Most Americans saw their withholding rate move from 28% down to 24%. If all things remained equal, everyone would receive a smaller refund, or be handed a lower tax bill, when they filed their 2018 taxes.

We know of course, that all things aren’t equal. Deductions changed, rates were lowered, etc.

So how do you know what effect the tax law had on you personally?

Figuring your effective tax rate

Anyone can view the tax tables on the IRS web site (or a more simplified version from nerdwallet), but that only paints part of the picture. You had deductions, either standard or itemized, maybe you had tax credits, and maybe you had income that was taxed differently (like dividends!).

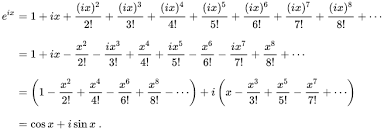

Calculating your effective tax rate is easy, all you need is two numbers. Divide your total tax paid (line 63 on your 1040) by your total taxable income (line 43 on your 1040). If you made $50,000 and paid $5,000 in taxes, your effective tax rate is:

5,000 / 50,000 = .10 or 10%

If you calculate the number from years past, or at least 2017, you’ll have some idea on whether the effect of the tax law was positive or negative for you.

Our final outcome

Looking back over three years of marriage was sorta fun, in a “I love math” nerdy sorta way. For 2016, our household had an effective tax rate of 26.12%.

In 2017, luckily for us, our taxable income increased! We saw a 5.43% increase in our overall taxable income. But of course,, our taxes owed increased as well. In fact, that figure jumped 6.63%, causing our effective rate to increase slightly to 26.41%. Ouch.

Now we’re on to 2018. Both myself and Mrs. Benjamins saw our income increase, and thanks to additional investing activities, we had that income to report as well. In 2018, our taxable income increased 16.53%. Yay us! Interestingly enough, our taxes owed actually DECREASED 7.64%. Our effective tax rate fell to 20.94%

| Year | Tax Rate |

| 2016 | 26.12% |

| 2017 | 26.41% |

| 2018 | 20.94% |

We made more money and paid less taxes. I guess

Thanks, President Trump

are in order.

One Reply to “Thanks, President Trump. A 2018 Tax Return Tale”