August was another fairly uneventful month, as we saw the S+P 500 index climb another 3.03%, while the Benjamins’ portfolio increase 3.69%. Gotta love the power of constant, regular investments.

August was another fairly uneventful month, as we saw the S+P 500 index climb another 3.03%, while the Benjamins’ portfolio increase 3.69%. Gotta love the power of constant, regular investments.

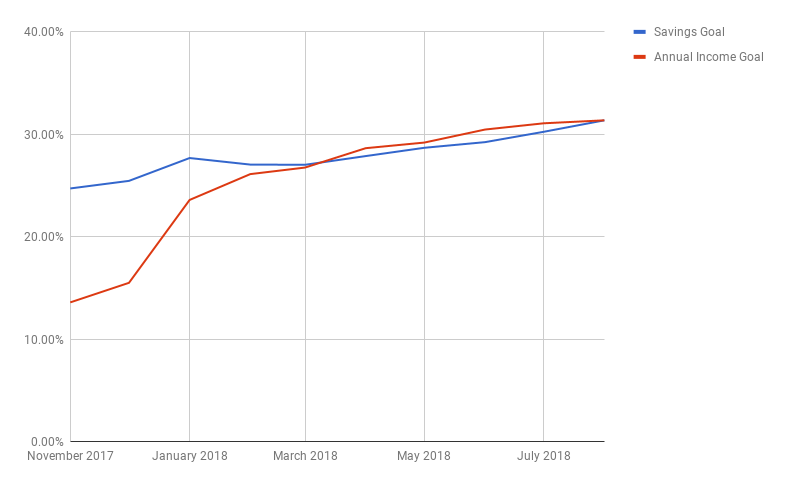

We got 1.12% closer to our overall savings goal, but only 0.29% closer to our projected annual dividend goal.

Interestingly enough, our distance to both our overall savings goal and our desired annual dividend income are identical.

I made two new stock purchases this month: 50 shares of Invesco @ $25.10 and 20 shares of Cardinal Health $51.59.

Here are updated account numbers as of August, 2018:

Formula = Savings x Yield = Annual Income

Savings: Total of all savings as a percentage of the total goal

Dividend Yield: Current yield of all tracked holdings (now including 401k’s!)

Annual Income: Expected dividends from all holdings as a percentage of the overall goal (now including 401k’s!)

On to the numbers!

Savings Goal = 31.37% (+1.12% / 3.69% increase)

Overall Portfolio Yield = 3.22%

Annual Income Goal = 31.37% (+0.29% / 0.93% increase)